Calculating financial risk officials will close dozens of China Gold Exchange

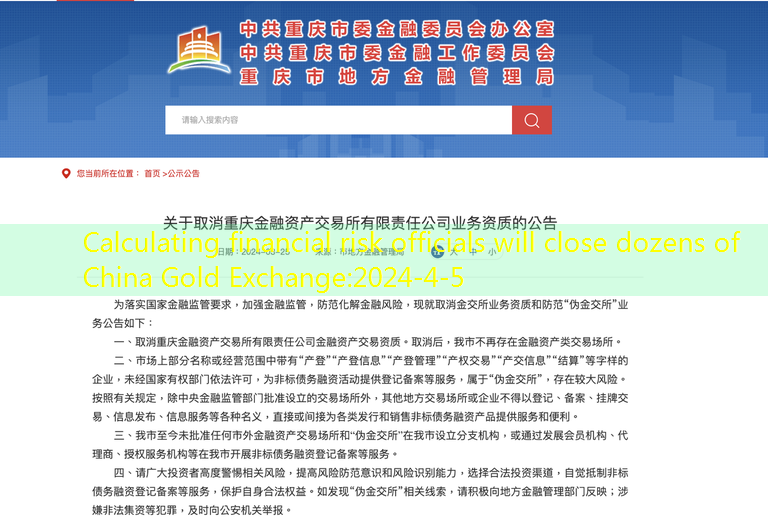

Local financial regulatory departments in Hunan, Liaoning, Xi’an, and Chongqing have announced that they have canceled the business qualifications of the Golden Exchange and requested that except for trading venues approved by the central financial regulatory authorities, other local trading venues or enterprises cannot “register, register, register,”File” and other names, directly or indirectly provide services and convenience for various types of issuance and sales of non -standard debt financing products.

Chinese governments are closing decisions on the Gold Exchange (financial asset trading center) engaged in financial transactions to prevent institutions from making financing and selling wealth management products. Dozens of such financial trading platforms across the country may be shut down.EssenceAccording to the Securities Times website on Tuesday, the local financial regulatory authorities of Hunan, Liaoning, Xi’an (Shaanxi Province), and the local financial regulatory authorities of Chongqing have announced that they will cancel the business qualifications of the Gold Exchange in their respective jurisdictions.There are no longer the qualifications for the relevant business of the Golden Exchange.The announcement further reminded the risk of the “Pseudo -Gold Exchange”, and requested that except for the transaction venue approved by the central financial regulatory authorities, other local trading venues or enterprises must not be “registered or filing”.All kinds of issuance and sales of non -standard debt financing products provide services and convenience.

The reporter learned from a number of industry insiders and authoritative people close to supervision that the actions of the above four provinces and cities are just beginning, and there will be more places to issue announcements to cancel the qualifications of the Gold Exchange in the Jurisdiction.This means that the Golden Exchange, which has appeared in many financial risks and frequently appeared in many local trading venues, is about to completely withdraw from the historical stage.

Officials call the financial exchanges barbarous growth

Financial commentator Zheng Xuguang said in an interview with Liberty Asia on the same day that the official licenseed Golden Exchange’s activities will be curbed: “These Gold Exchange is difficult to support by compliance business because there is no enough business volume.The business that does not meet the regulations believes that this brings a lot of problems, including financial risks. In fact, we have seen that many financial derivatives have been promoting in recent years, and many may be fraudulent. “

It is reported that for those “pseudo -gold exchanges” that are active in various financing activities under the banner of the Gold Exchange, the complete exit of the Gold Exchange is like a salary at the bottom of the kettle.It can be predicted that those “pseudo -gold stocks” that have long been engaged in illegal financial activities for a long time will face more severe blows and cleanups, and even have the possibility of criminal accountability in the future.

In this regard, Zheng Xuguang said that the Golden Exchange endorsed the local government: “The power of the Gold Exchange authorized by the state will be canceled. The business of the derivative wealth management products does not recognize the government.Xi’an) and Chongqing’s four places cancel the Golden Exchange, similar to the cleanup of local financing platforms, that is, to eliminate the soil of financial explosion. “

It is understood that the Golden Exchange canceled by the Government of Hunan and other places is Hunan Financial Assets Trading Center Co., Ltd., Liaoning Financial Assets Trading Center Co., Ltd., and Xi’an Baikin Financial Asset Trading Center Co., Ltd.company.

There are nearly 30 Golden Exchange in China, which was close to 80 at its peak.The Securities Times learned from a number of people in the industry and authoritative persons close to supervision that the above four provinces and cities announced that it was not accidental, but began to stop all the Golden Exchange in succession.

The amount of transaction volume of financial exchanges is low, resulting in closed transactions

In an interview with this station, the chief of the financial scholar stated that the main reason for the Gold Exchange’s closure is related to the insufficient transaction volume: “The real reason for the Golden Exchange is because the transaction volume is small, and there is no sufficient trading entity. This is essentially because of China’s.The total economic volume is not enough to support transaction activity. Therefore, it is a matter sooner or later. “

According to reports, the decision on whether to shut down all the Golden Exchange seems to have been brewing within the supervision.A person who had served as an executive at a certain Gold Exchange told the Securities Times reporter that as early as the end of 2022, the relevant departments convened some local governments and the Gold Exchange to investigate and collect the possibility of the Gold Exchange.Recently, the dust finally settled, and decided to clear all the existing deposits in an orderly manner, and it is clear that it will not be established in all places in the future.

Commander said that financial trading activities are like a mirror with real economic activity. When the amount of real economic activity decreases, the demand for financing has decreased: “He is the true portrayal of China’s serious decline in recent years.”

China’s first Golden Stock Exchange Tianjin Financial Asset Exchange was announced in May 2010.Since then, the Gold Exchange has been established in various places.Since then, many companies and third -party wealth management companies have participated in illegal financing products.